montgomery al sales tax registration

The mission of the Montgomery County GIS and Cadastral Mapping Department is to work in partnership with county agencies to provide accurate consistent accessible and comprehensive GIS data GIS infrastructure and GIS services to support the GIS needs of Montgomery County and the. The Montgomery County Commissions responsibilities include control of all county public funds adoption of an annual budget reflecting anticipated income and expenses by law expenditures cannot exceed revenue received.

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Why Buy From McKinnon Toyota.

. Our sales consultant Brian did a decent job still learning. Marketplace-E Sold on 11122. While I cant say that I will make the 10-hour round.

A Division of The Montgomery County Revenue Commissioners Office. 10 of the final selling price. The sales manager Ryan was welcoming and hospitable.

Therefore unlike registration fees taxes accumulate even when a vehicle is not used on the highway. You currently do not have any price drop alerts. Sellers Use Tax is imposed on the retail sale of tangible personal property sold in Alabama by entities located outside of Alabama which have no inventory located in Alabama but are making retail sales in Alabama via sales offices agents website or.

485 of the final selling price min 1200 Above 75000. You can add price drop alerts by viewing a vehicle and clicking the button. You currently do not have any favorites.

My Price Drop Alerts. Other major areas of responsibilities include construction and maintenance of roads in the county outside the city jurisdiction providing services for all. Montgomery New York United States.

As stated above Ad valorem tax is a property tax and not a use tax and follows the property from owner to owner. Sales manager was matter of fact in his dealings with me and while he needed to explain other services available like service and warranty contracts he did not twist my arm and was very considerate of my time. Pay all ad valorem tax that has accrued on the purchased vehicle since.

Sales Tax is a privilege tax imposed on the retail sale of tangible personal property sold in Alabama by entities located in Alabama. View All New Inventory. Buyer must pay a transaction fee based on the final selling price.

This item is subject to New York sales tax. When an Alabama resident buys a vehicle with an outstanding ad valorem tax lien the buyer must. 888 825-8308 Quick Lane.

You must create an account to use price drop alerts.

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Alabama Sales Tax Bond Jet Insurance Company

Sales Tax Audit Montgomery County Al

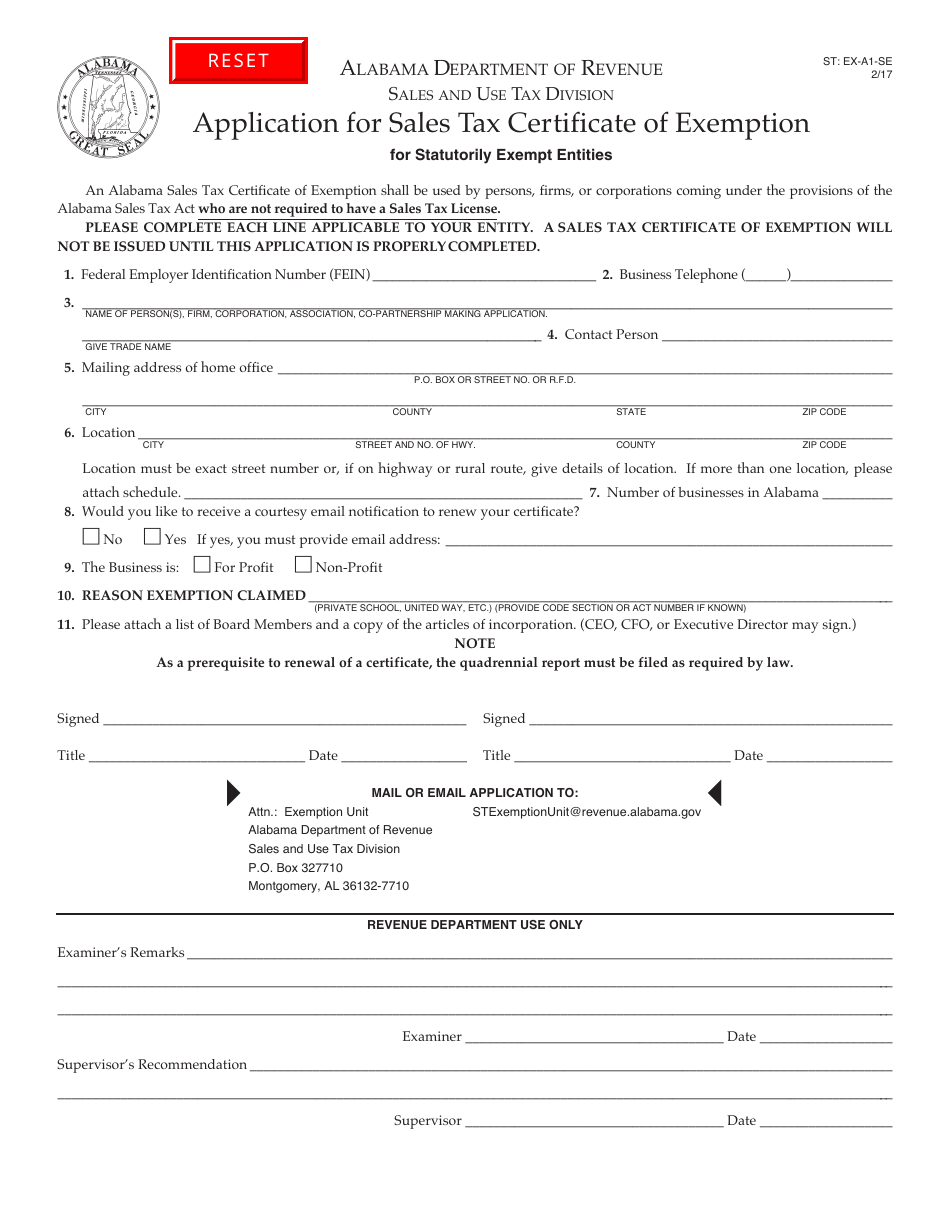

Form St Ex A1 Se Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption For Statutorily Exempt Entities Alabama Templateroller

Learn How To Register Private Limited Company In India Private Limited Company Limited Company Business Risk